how to take an owner's draw in quickbooks

A clip from Mastering QuickBooks Made Easy. If you have any video requests or tutorials you would like to see make sure to leave them in the com.

How To Record An Owner S Draw The Yarnybookkeeper

Learn about Recording an Owners Draw in Intuit QuickBooks Online with the complete ad-free training course here.

. For a company taxed as a sole proprietor or partnership I recommend you have the following for ownerpartner equity accounts one set for each partner if a partnership name. This tutorial will show you how to record an owners equity draw in QuickBooks OnlineIf you have any questions please feel free to ask. Set up draw accounts.

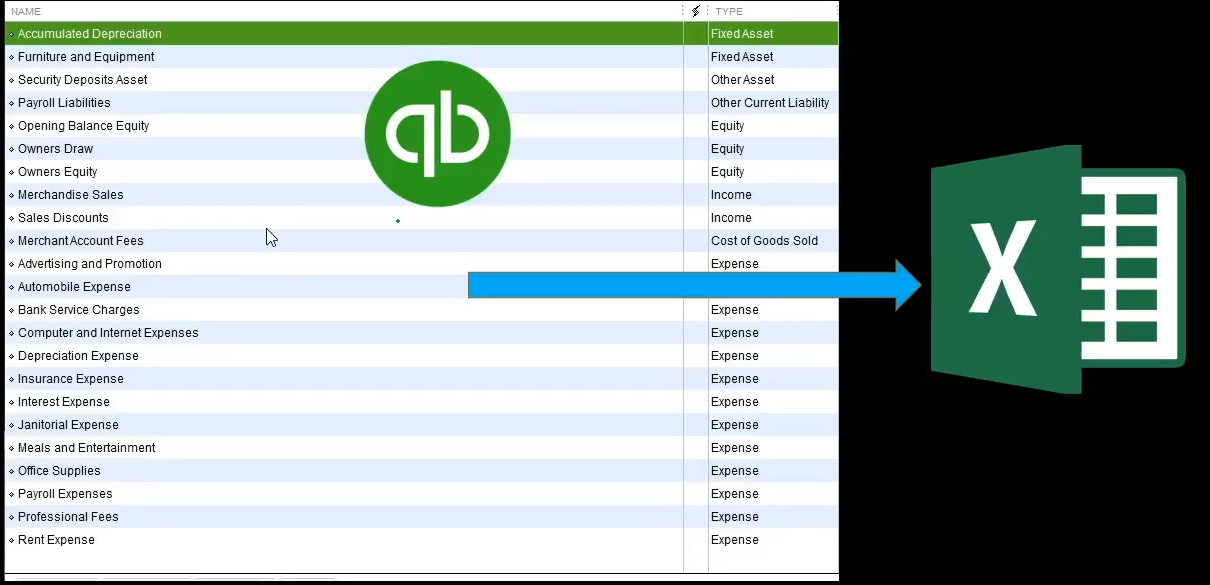

Visit the Lists option from the main menu followed by Chart of Accounts. Before you can pay an owners draw you need to create an Owners Equity account. If you would like to get setup to manage your business finances on QuickBooks Online reach out.

Step 5 Enter the total for the. Before you can record an owners draw youll first need to set one up in your Quickbooks account. Open the chart of accounts and choose Add Add a new Equity account and title it Owners Draws If there is more than one owner make separate.

In this video Ill show you how to enter the owners draw in QuickBooks Online. Official Site Smart Tools. Click the Account field drop-down menu in the Expenses tab.

Enter your name on the Pay to the Order of line. Pick the transaction click on the Categorise option pick out Expense because the transaction type myself because the SupplierCustomer and Owners Equity. Please refer to these following steps.

Select Petty Cash or Owners Draw depending on the method you want to use to track funds. You dont have to commit to one lump sum for the year when you take an owners draw. Select the bank account from which you want to take the owner draw from the drop-down box at the top of the window.

The very first steps will be towards creating the owners draw account. Firstly You need to choose the. Dont forget to like and subscribe.

Create an Owners Equity account. Take what you need for your current expenses and opt for additional. Owners Draw because the.

Quickbooks bookkeeping cashmanagementIn this tutorial I am demonstrating how to do an owners draw in QuickBooks------Please watch. Follow these steps to set up and pay the owner. Steps to Creating the Owners Draw Account.

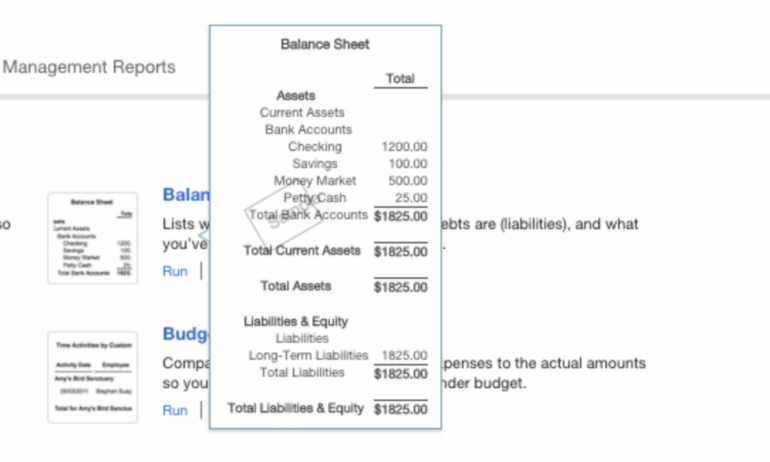

Quickbooks Financial Statements A Complete Guide Nerdwallet

How To Set Up A Chart Of Accounts In Quickbooks Qbalance Com

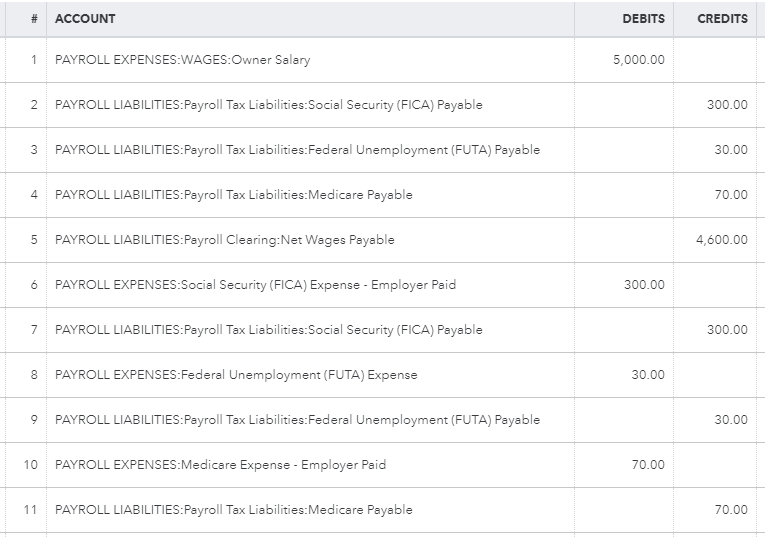

Solved Am I Entering Owner S Draw Correctly

Categorizing Transactions In Quickbooks Other Bookkeeping Software Network Antics

Hi How Do I Enter Track Owners Draw Payments

Things You Can Do With Quickbooks Resolved

Quickbooks Owner Draws Contributions Youtube

How To Record Owner S Capital In Quickbooks

How Do I Set Up Owners Equity In Quickbooks What Is An Owner Draw In Quickbooks There Are Many Different Ways That Y Quickbooks Quickbooks Online Distribution

Setup And Pay Owner S Draw In Quickbooks Online Desktop

Anatomy Of Expert Quickbooks Online Setup Lend A Hand Accounting Llc

Quickbooks Tip Applying Owner S Time For Job Costing Long For Success Llc

How To Record Owner S Capital In Quickbooks

How Do You Pay Yourself As The Owner Of The Business Bookkeeping Network

Quickbooks Instruction Archives Accounting Instruction Help How To Financial Managerial

How To Record Owner Investment In Quickbooks Updated Steps

Setting Up Your Quickbooks Online Company Part Six Insightfulaccountant Com

:max_bytes(150000):strip_icc()/ownersdraw-59a909e0333d40e1a5409cb74251931f.jpg)